What inverted yield curve means

We have been hearing about the inverted yield curve and how it signifies that recession is on the horizon. So what exactly is an 'inverted yield curve'?

|

| Source: Investipedia |

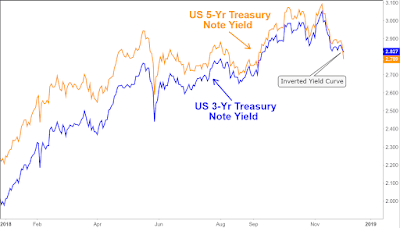

Let's take a look at the above chart. Short term yield is represented by the blue line (US 3-Yr Treasury Note) and long term yield is represented by the orange line (US 5-Yr Treasury Note). We can also substitute the 5-Yr note with say a 10-Yr note. As we can see, the orange line (short term yield) logically should stay above the blue line, since the note / bond holders are expecting higher compensation for the longer time frame of holding it and with a longer time frame comes more uncertainty. The right hand side indicated a point of inversion - when the orange line falls below the blue line. Why would this happen?

As I am not good at explaining the technical stuff, so I shall leave that explaining to Investopedia here.

Some important points I want to highlight are as follow:

"As the economic cycle begins to slow, perhaps due to interest rate hikes by the Federal Reserve Bank, the upward slope of the yield curve tends to flatten as short-term rates increase and longer yields stay stable or decline slightly. In this environment, investors see long-term yields as an acceptable substitute for the potential of lower returns in equities and other asset classes, which tend to increase bond prices and reduce yields."

So when more people choose to invest in longer term yield, naturally the price gets pushed up. It's the logic of supply and demand. So when price goes up, yield comes down. (Same as any dividend stocks.)

"As concerns of an impending recession increase, investors tend to buy long Treasury bonds based on the premise that they offer a safe harbor from falling equities markets, provide preservation of capital and have potential for appreciation in value as interest rates decline. As a result of the rotation to long maturities, yields can fall below short-term rates, forming an inverted yield curve."

This is telling us how market sentiment can affect the yield curve. Vice versa, yield curve could also affect market sentiment, albeit to a lesser extend than some big header news. Will it become a viscous cycle come a recession?

"Despite their consequences for some parties, yield-curve inversions tend to have less impact on consumer staples and healthcare companies, which are not interest-rate dependent. This relationship becomes clear when an inverted yield curve precedes a recession. When this occurs, investors tend to turn to defensive stocks, such as those in the food, oil and tobacco industries, which are often less affected by downturns in the economy."

So observe the shift in big money.

In the "one word go up, one word go down" market, trading counters that have as little correlation as possible to trade war news would be deemed the most defensive.

I shall keep my fingers crossed that my trading portfolio can remain in the green till end of 2019!

So observe the shift in big money.

Despite the yield curve inversion, I feel that we need not be overly worried about it. Firstly, we do not know how long will the curve stays inverted (it could flip back anytime). Secondly, I think president Trump will not allow the US economy to sink, not even if there is a full-blown trade war (now it is still a tug-o-war that has no clear winner and election is coming 2020). We all also know now that there are so many different "patterns" that they can play with for their monetary policies...

See link below if you are interested to read more.

Instead of worrying and doing nothing, we should be periodically balancing our investment portfolios and buying in to dip opportunities. At the same time, we should also have a plan on what to do in the event if recession strikes.

In the "one word go up, one word go down" market, trading counters that have as little correlation as possible to trade war news would be deemed the most defensive.

I shall keep my fingers crossed that my trading portfolio can remain in the green till end of 2019!

***

Check out my Blog Archives here for previous posts

Comments

Post a Comment