My DeFi adventure

Right before the mega crypto crash last week, I have created a new wallet seeded with some fresh funds to play on Defi.

How dumb a timing can that be right? Especially when I just blogged about crypto cycle and DCA.

Nevertheless, I think it's a good learning experience and I didn't regret for not sitting on my hands. Let me share some quick takeaways that I have from dabbling in this very intriguing space. (Due to the high gas cost when I started, I migrated most of my funds to Polygon which is a Layer 2 solution to bypass the high gas cost on the Ethereum mainnet.)

SushiSwap liquidity mining

- When there's high price volatility, yield increases exponentially - so does Impermanently Loss (IPL).

- The time when the IPL is close to zero (best timing to withdraw from LP) is when the ratio of the two pooled assets remain almost the same (eg. they have risen or fallen correspondingly with each other).

- However, this can seldom happen unless we are pooling only stablecoin pairs. (Which can but rarely lose peg.)

- Often than not, one will end up with IPL that eats into the yield and a portion of your capital becomes "yield" for the arbitragers.

- So if you see any opportunity to arbitrage, just feed yourself with your own

poisonheal potion. - And remember to stake LP "receipt" which is SLP to farm yield MATIC and SUSHI to complete the yield package.

Aave "ponzi" - borrow to yield

Since I am on Polygon, I decided to try out the "ponzi" that was published all over, while staying close to the sidewalk.

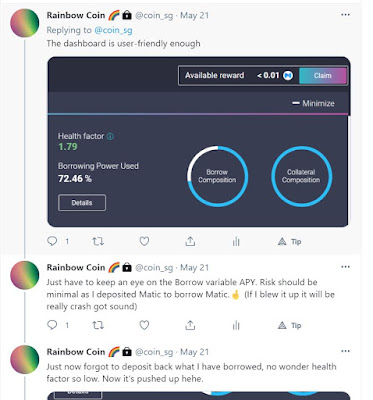

What I did was to simply swap for some MATIC to deposit and borrow MATIC, which I again deposited. I aim to keep my health factor at around 2 in view of all the volatility, cos the last thing I want is to get liquidated. When the MATIC price plunges, my health factor rose and I can borrow more MATIC to earn more APY. When MATIC price increases, I roll back to repay some debt.

- Do keep an eye on the borrow APY to ensure that we are earning and not losing (the borrow reward APY kept dropping, darn). Otherwise, just promptly repay all debts.

- The reward is issued as WMATIC (wrapped MATIC) which I can go to Quickswap to unwrap.

- Deposits in Aave will get issued receipt, which will appear in the wallet as amWMatic.

- Unlike SLP, they can't be staked. Just make sure not to lose them.

- If the tokens did not appear in wallet, fret not. Usually they will appear after you try to do some transaction eg. on Quickswap. For Sushi, you also can click on the button "Add sushi token" on their platform. ( I almost had a heart attack when I first bridged over and see no token in my wallet!)

Of course, there are other strategies to yield more MATIC rewards out there. However, do note that more complex strategies might give rise to certain issues eg.

- Higher exposure to smart contract risks if using more than 1 platform for inter-dependable yield functions.

- Congestion / reaction time risk when you need to take back deposited funds for a prompt debt repayment

- Opportunity cost if the asset used to farm is not a growth asset

I have not been in this space for long, so if any of the above differs from what you have experienced or understand, please feel free to comment below.

As usual, whatever's written here is NOT financial or investment advice.

Dyodd and RISK MANAGEMENT should always be top priority. Whatever you chose to stake in is YOUR MONEY at stake.

|

| Source: https://wisdomquotes.com/knowledge-quotes/ |

Comments

Post a Comment