Lessons learnt on money flow and elevated interest

This is a period of biggest interest rate and inflation rate hike which I have seen since I started blogging.

Banks are pumping up interest rates in the shortest time span ever. (I saw that CIMB is currently offering as high as 4.2% on its fixed deposit! A rise of 1-2% in interest from just a few months ago. Darn, I should have waited.)

This interest hiking spree is attributed to FED's rate hike, which caused the treasury bills yield to be climbing for a while. Hot money (from past QEs) have been flowing out of risk assets (cryptos, equities, junk bonds etc) to the supposedly more secure assets (bank deposits and gov bonds). Note that periods of past FED rate hikes are in year 1999-2000, 2004-2006 and 2007-2008. Then we see rate cuts after these periods.

Inflation and loans interest rates have been climbing too. Layoffs are starting, economy seemed to be slowing. We won't be surprised to see recession, perhaps from next year, if the FED rate hike and inflation continue at this pace. Gotta keep a watch out for recession trends like a rise in the unemployment rate and a decrease in GDP.

War chest

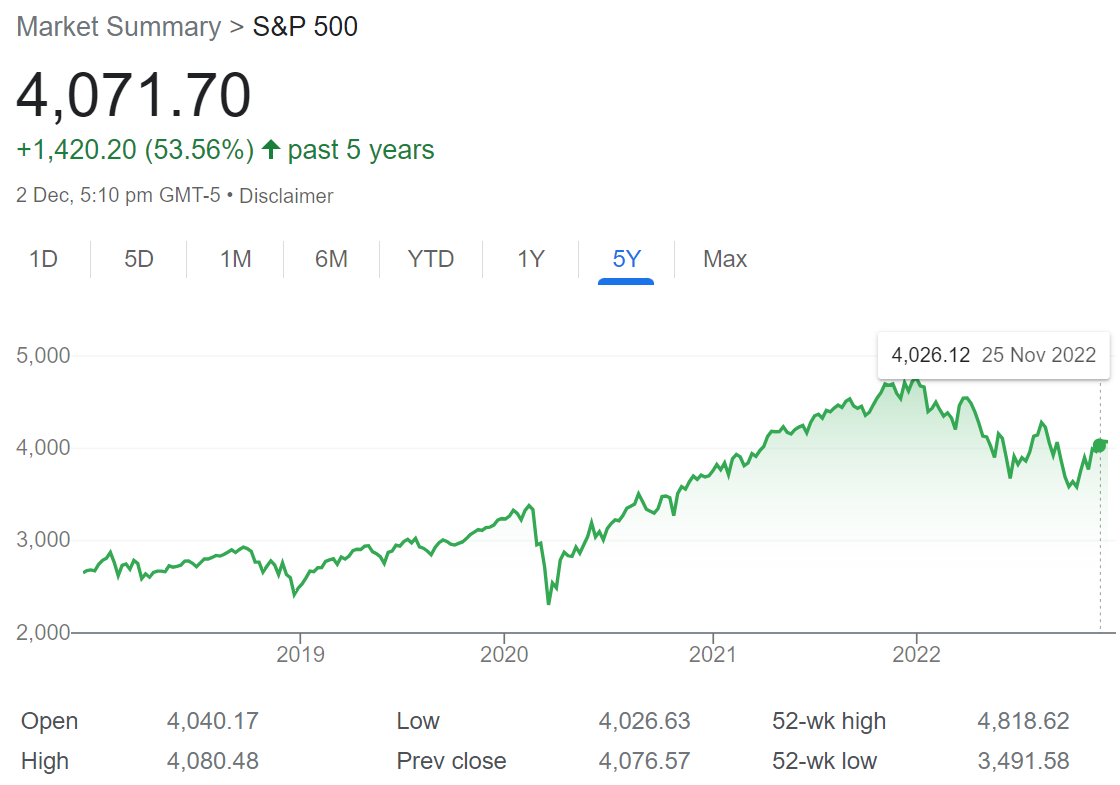

I am trying to fatten up my war chest now in preparation for a recession and stock market crash. We are somehow still not in full-blown bear market yet. US market looks like it will chop up and down for a while.

I was unfortunate to have acted too slowly before the major funds shift so my war chest has not much harvest from the bull run, but I was fortunate to have little US equities long exposure this year.

If you have a war chest, remember to first settle any debts that have increasing rates.

[Hindsight wisdom: I should have sold my REITs holdings.]

Cash parking

Money sitting idle in the war chest waiting to be deployed has to be parked somewhere secure with stable yields. So I split the money into liquid, less-liquid and illiquid placements, with staggered placement durations.

- Liquid placements are money that I can touch in 1 month or less, without paying penalties, should I need to withdraw them. They are Singapore Saving Bonds, Endowus funds, bond funds, Singlife (base 1.5% int), Trust account (2% int), Multiplier account (up to 4.1% int) and other banks that run short-term saving accounts fresh fund promos eg. Standard Chartered (3.75% int).

- Less-liquid placements are SAYE (3.5% int t&c penalize for early withdrawal) and fixed deposit (early withdrawal fees may apply).

- Illiquid placements are the Singapore T-bills and SGS bonds (no early redemption before maturity date!). I chose the placement for 6 months T-bill which is not too long yet decent yielding. My competitive bid last month for 4% failed but I will be trying again. Instructions on how to apply for T-bill can be found here.

Who would want to lock money into their CPF with such good yields around? For tax relief, SRS definitely has more flexibility than the our see-no-touch Retirement Account.

Reallocation

I have also been busy reallocating within the placements, prioritizing those with the highest yield.

I am doing SSB recycling monthly - redeeming old placements with lower yields and applying for new placements with higher yields.

Risk assets

Most of my SG equities are in limbo. The "rotten eggs" are too rotten to sell eg. HST. My gut feel tells me to just hold and wait for a rebound, although that could mean seeing them plunge further if recession comes. Any near-term rebound might be a sell opportunity.

I am still trading US equities and options, not holding anything for long-term. My intended long term exposure was through Endowus by DCA but I am not going to start that anytime soon. DCA when the market is crashing into a bear state is bad move. DCA when the market is at pit bottom and going to start seeing light is good move. I believe in market-timing DCA (yeah I know it sounds ironic lol).

I was lucky to withdraw my crypto from FTX's blockfolio before the bank run happened, thanks to a buddy who alerted me to CZ's tweets. After learning my lesson hard with Celsius, I did not want to take a chance this time round. The contagion effects of FTX's collapse spreaded like wild fire (Better Spider has a detailed post here with lessons to learn) and many big institutions got badly burnt. Now most of my crypto left are parked in Defi and cold wallet.

Takeaways

Nothing is too big to fail. When something fail, no amount of reputation can save it. Don't believe in words of reassurance or get too reassured by / confident with "official sources".

Don't take chances when wind direction change. Place your eggs in different baskets and do make sure that these baskets are closely related.

Take responsibility for your own investments and money management. Choose your baskets carefully and monitor your eggs.

Lastly, reflect:

Did you invest enough to prepare for the bull?

Did you harvest enough to prepare for the bear?

Thanks for reading!

Get a $10 Fairprice e-voucher when you sign up on the Trust bank app using my referral "8E73GQZ6" and start earning up to 2.5% p.a. interest rate on your deposits.

Get $20 bill rebate with TUAS power when you sign up with my referral code "RCPKNX4".

Do check out my other referrals here for more sign up bonuses.

🤗

Rainbow girl,

ReplyDeleteFirst of all, glad you got your cryptos out BEFORE the bank run on FTX!

Nothing helps us in risk management more by getting our fingers "burnt"; you have not let your Celsius experience gone to waste.

Secondly, market timing DCA?

Impressive. No more off-the-rack; its bespoke just for you!

Hi SMOL,

DeleteYeah bespoke... paused all my Roboadvisor account's DCA.

When equities and bonds come crashing down, neither DCA nor reallocation make any profit sense.