Stratifying your assets (diversification)

When we talk about diversification, it means building a portfolio with assets that are not highly correlated.

"Diversification is a risk management strategy that mixes a wide variety of investments within a portfolio. A diversified portfolio contains a mix of distinct asset types and investment vehicles in an attempt at limiting exposure to any single asset or risk." - Source: Investopedia

Below is a table classifying the various assets and how within each asset class further diversification can be put in place according to sector, geography, risks and liquidity.

| Asset classes | -Sector / Type | -Geography | -Risk profiles | -Liquidity |

| Real Estate | sector | v | variable | low |

| Commodities | type | low, variable | high | |

| Derivatives eg. Future, ETF | sector | v | high | high |

| Equities | sector | v | high | high |

| Bonds | sector | v | low | low, variable |

| Exchange-traded funds (ETFs) | sector | v | variable | high, variable |

| Cryptocurrencies | type | high | high, variable | |

| Collectibles | type | low | low, variable | |

| Cash and cash equivalents | v | low | high |

In a massive market plunge (like now), people would start scrambling to cover margin calls, get emergency cashflow and moving their money to "safer" assets from the higher risk ones.

So much so that even the lower risk assets are not spared from the massacre when correlations break down*, eg. bonds vs stocks, crypto vs gold, yen vs usd.

Paper assets, especially derivatives and equities, typically are the first ones to "go". ~Sayonara. In extreme cases, gold and cash would be the only good hedges (besides Put options and CFD short positions for the traders). Gov bond could also rise in price as people flocked to it as safe haven after the initial "scare".

If you find yourself with a poorly diversified portfolio you might find yourself "trapped" when certain market situation arises like the recent crash. Take it as a lesson and a good time to review what you can do differently for your portfolio moving forward.

* "This was a major relief as the collapse of crude prices had blown a huge hole in the budgets of many oil producers and forced them to dump any liquid asset to raise cash, with U.S. Treasuries a particular casualty."

"At the same time, funds across the world were fleeing to the liquidity of U.S. dollars, lifting it to peaks last seen in January 2017 against a basket of its peers." Source: Reuters

When planning your asset allocation, do take note of the following:

"Understanding and anticipating the power of correlation—and thus the limitations of diversification—is a principal aspect of risk control and portfolio management, but it’s very hard to accomplish. The failure to correctly anticipate co-movement within a portfolio is a critical source of investment error."

- Howard Marks (in The Most Important Things Illuminated)

- Howard Marks (in The Most Important Things Illuminated)

|

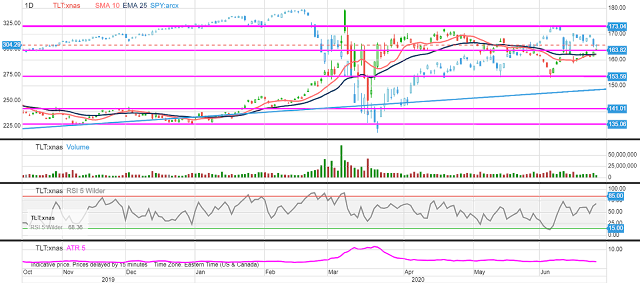

| Snapshot of TLT versus SPY (overlay) Jan - Jun 2020. Image Source: SAXO |

We have hit the year 2011 and 2016 low in STI. STI closed at a record low of 2495 yesterday (a whooping -5% drop in one day), it further declined 2% today.

Only for those who have been through the PIIG and oil crisis and actually picked up stocks during those period of lows would have sit on less than 10% drop. Those whose portfolios are still green (not counting dividends yielded) are probably the qian bei men who fished in the GFC time.

In the oil crisis, my portfolio was down by 30%. I caught a falling knife. This round I am trying hard not to but I didn't have the heart to cut losses. I think there's more losses to be stomached till market bottoms out (we can only guess).

--

"Those that did not have a long enough track record don’t worry. In time, you will understand why Warren Buffet says don’t lose money. And why not having a down year works wonder with compounded returns for Peter Lynch.

Traders learnt very quickly you can’t play when you have no chips.

Investors may take longer as we can hide under the “it’s for the long term denial”…

It does not matter what you call yourself – value, growth, dividend, long term, etc. It’s our track record that determines whether we are successful or poor investor."

- quoted from SMOL

In investing, no matter what tools / skills you use at the end of the day it is the track record (money made) that truly matters.

Related posts:

Like what you read? Follow me on Facebook or Twitter for updates and news that I dig.

Check out my referrals for fantastic sign up bonuses on SAXO, Moomoo, Gemini, Celsius, Blockfi and more.

🤗

Thanks for reading!

Disclaimer: Contents of this blog are personal opinions and NOT financial advice to buy or sell any mentioned securities, commodities or assets.

Rainbow girl,

ReplyDeleteIts deja vu for me.

We were having the same discussions in 2012 ;)

Stocks go up; stocks go down.

Just like the ocean tides.

Nothing more; nothing less.

If we don't chop fingers and capitulate, we'll see new higher highs as in STI above 4000, and lower lows as in STI below 2000 before our candles are snuffed out forever.

What counts is what actions we took in between ;)

Hi SMOL,

DeleteYeah we have waited long for the bear but this one is simply too fast and furious for some proper reaction time.

This month we have seen it's true fury as it reared its ugly head. Fear abound.

What counts is not only the what but also the when. Cannot anyhow be bear hunter if not properly armed.