3 power crypto articles from 2021

The crypto space is ever changing and as we dive deeper into the space, the stuff to read seems to increase exponentially.

Among many great crypto articles I have read last year, I have curated three of which I felt are still relevant to date and very insightful. If you are looking to read more brain-stimulating articles, you could also check out my recommendations in the Weekend Brain Food series (mostly are non-crypto related).

So here we go.

Trading the metagame

"Watching the winners & locating the problems in crypto can be a way of identifying potential metagames in advance."

"Sometimes you can simply see that you missed the current meta and use that info to exit positions that are out of meta to preserve value, or just take a break and restore mental energy. As the meta and attention shifts to new things, capital bleeds out of previous metas. People sell the last meta they fomo’d for the next one. It’s a video game. Players want to play, they don’t want to be idle.

Traders use the meta to exit/rebalance longer-term positions. If you had a big position in some token, which suddenly became meta, even if you have a long-term thesis around the asset, it might be a good idea sometimes to rotate out of it at exuberance and rotate back in when the meta has moved on to whatever is trendy next to compound your position size."

"So, if you already thought 5 or 6 times about taking a trade, weeks/months have passed, and you have finally plucked up the courage to do it: you’re probably too late. It doesn’t feel risky anymore, which means it’s probably maximally risky."

Defi’s Competitive Advantages: What’s Real and What’s Not

There are three value propositions by the author for Defi, namely

Value proposition 1: Low operating cost by design

Value proposition 2: High capital efficiency

Value proposition 3: Co-op ownership model

She also addressed certain criticisms on Defi in her article. I agree on the part about lacking in real world application of Defi when it comes to non-crypto assets and how it may eventually be solved. My related post: Some thoughts on tokens and asset-backed crypto

"There’ll be a big industry whose sole function is maintaining the linkage between real world properties & their NFTs. Once you transfer the asset function of off-chain entities into NFTs, DeFi can take it from there."

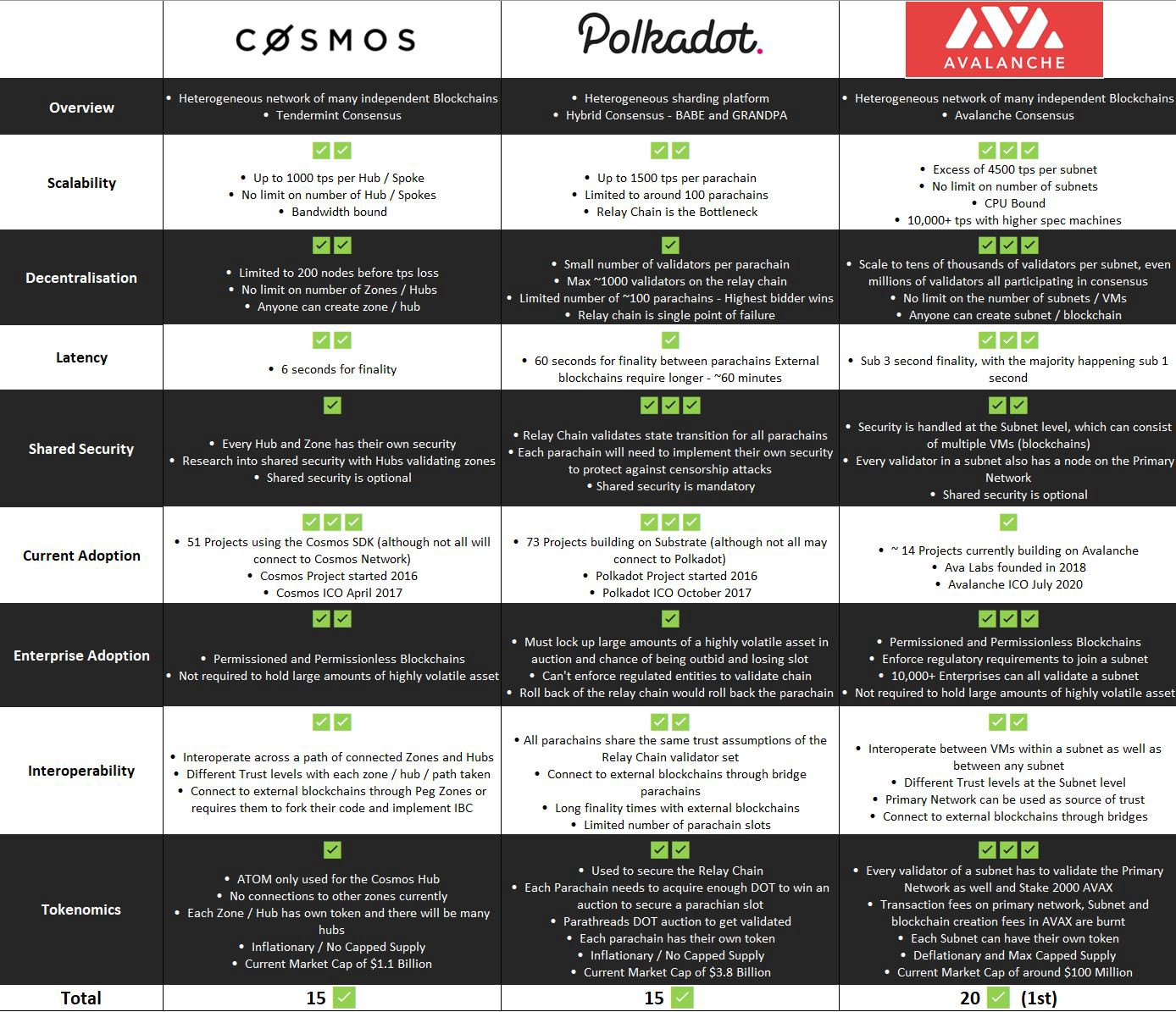

Comparison between Avalanche, Cosmos and Polkadot

These three Layer1 blockchains share the commonality of having an interoperable network within their chains. This article walks us through the features and limitations of each.

TLDR:

Related article: What are Parachains?

---

I hope you enjoyed reading the above articles as much as I do.

Here's a CT that perfectly summed up the crypto market last year:

2021 was good to crypto.

— Tascha (@TaschaLabs) December 12, 2021

Next year things will look different b/c of changes in macro environment & tech adoption cycle.

Here are top 3 crypto investment themes I’m bullish 📈 & bearish 📉 about for 2022 👇

The only thing I regretted was not selling enough. Harvesting in summer so that I can hibernate in winter!

Tascha Labs has written an article on the themes that might play out in year 2022 which is worth a look.

I always have no luck with my crystal ball so I shall not attempt any prediction here but my conviction on crypto's growth and mass adoption remains high.

Missed a CNY blog post this round. Wishing all a happy 2022! :)

Earn interest on your cryptocurrencies now on Celsius and get $50 free in BTC. Enter my referral code <197972828c> when creating your wallet, deposit $400 or more worth of crypto at the time of signup and hold for 30 days to claim.

You can also stack promo codes to earn more BTC rewards on top of the sign up bonus! Read about how to stack the promo codes here. Find more active promo codes here.

Like what you read? Follow me on Facebook or Twitter for updates and news I dig.

Check out my referrals for fantastic sign up bonuses on SAXO, Moomoo, Gemini, Celsius, Blockfi and more.

🤗

Thanks for reading!

Comments

Post a Comment